Along the Way

How I Unexpectedly Owed the IRS a Car

In my last monthly update post I alluded to the fact that our less than stellar savings rate for the month was because we had to write the IRS a large check. Large enough to buy a car. A new car, not a used one. Mr. BITA and I are […]

Stats and Gratitude

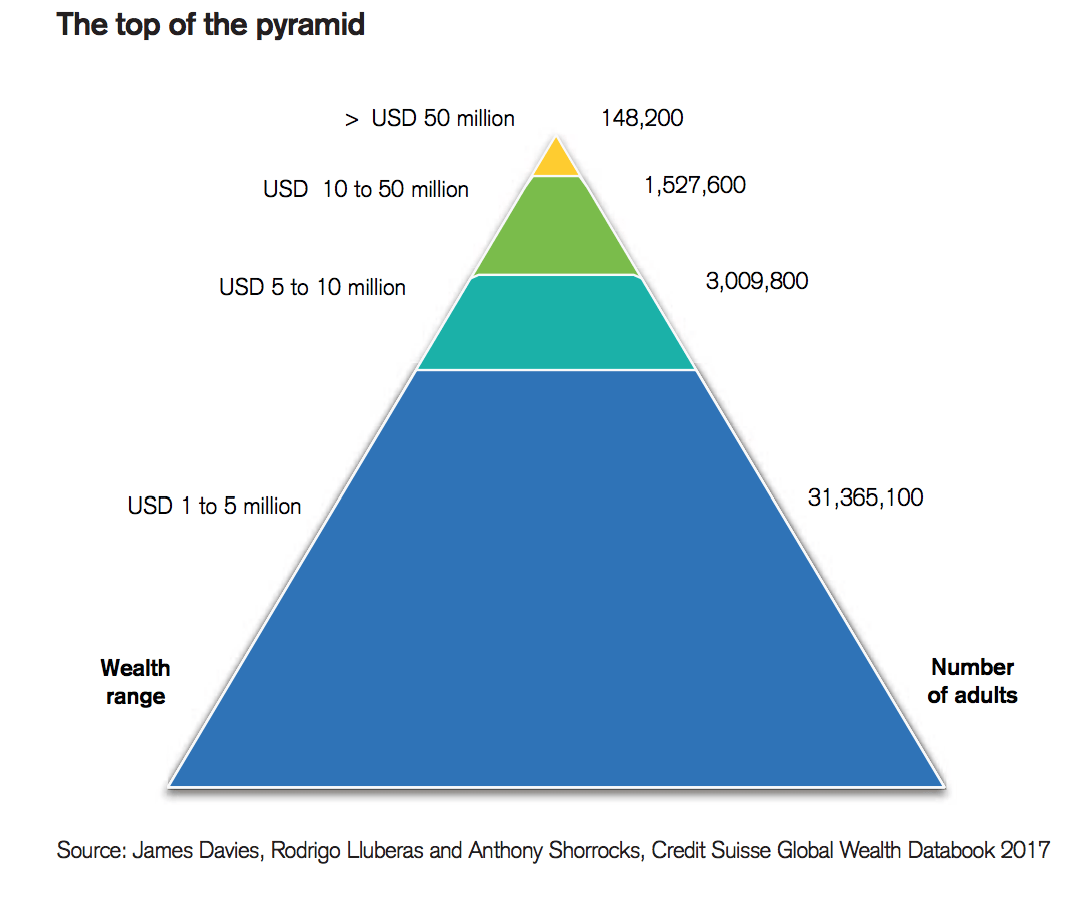

I recently read the Global Wealth Report for 2017 published by Credit Suisse Research. This is the eighth annual wealth report and it is chock full of interesting stats. Before we delve into some snippets from the report, let’s get the definition of wealth out of the way. The report […]

From DIKs To TIKs

Until recently the BITA household were DIKs. Not to be confused with dicks that you would like to punch in the face for being such arseholes, but DIKs – a Double Income family with one Kid. For those not familiar with this branch of financial taxonomy, I have, with the […]

Visualize Your Numbers

Have you ever wandered into the subreddit called /r/dataisbeautiful? I recommend it. The contributors to that subreddit take all sorts of data sources and come up with ways to present the data in picture-form. The results are generally very pleasing aesthetically. Over the last few days a certain kind […]

If I Can Do It, So Can You: A Financial Full Monty

Regular readers of this site know that the BITA family is accelerating towards financial independence as fast as we possibly can. In 2017 we have saved and invested north of $260,000 and we don’t intend to slow down until we reach the finish line. What regular readers don’t know are […]

Potential: The Why of Financial Independence

Imagine. Imagine what you would do if you woke one morning and discovered that you were financially independent. After you fainted, and awoke, and whooped, and celebrated and jubiliated and shouted wheeeee! to your heart’s content, what would you do? What would you do if money was no longer a […]

Don’t Make a Pest of Yourself

Discovering the concepts of financial independence and early retirement can be life changing. You hear the heavenly host, the clouds part and you are bathed in the light. One moment you are an ordinary Jane, doomed to drudgery for decades on end, the next you are a devout FIREee, and […]

The Unexpected Benefits of FIRE

Two days ago I went to the dentist. This is a big fucking deal because the last time I graced a dentist’s office was in 2012. A Horror Story The first clue that there was something off about my dentistry appeared when I was closing in on my 14th […]

I’ve Moved the Finish Line

Big news today! I am super excited to announce that I am pulling in my FIRE date, blog name be damned. I am thrilled and terrified, and so happy that I have you to share this with. A History Lesson A quick recap for those of you that haven’t […]

A Tale of Three Lounges

You haven’t heard from me in a while because the BITA family was on vacation. We were in Lisbon, Amsterdam and Split for nearly three glorious weeks. Becoming a productive member of the workforce again has been tough and I can barely wait for the day when the end of […]