Numbers

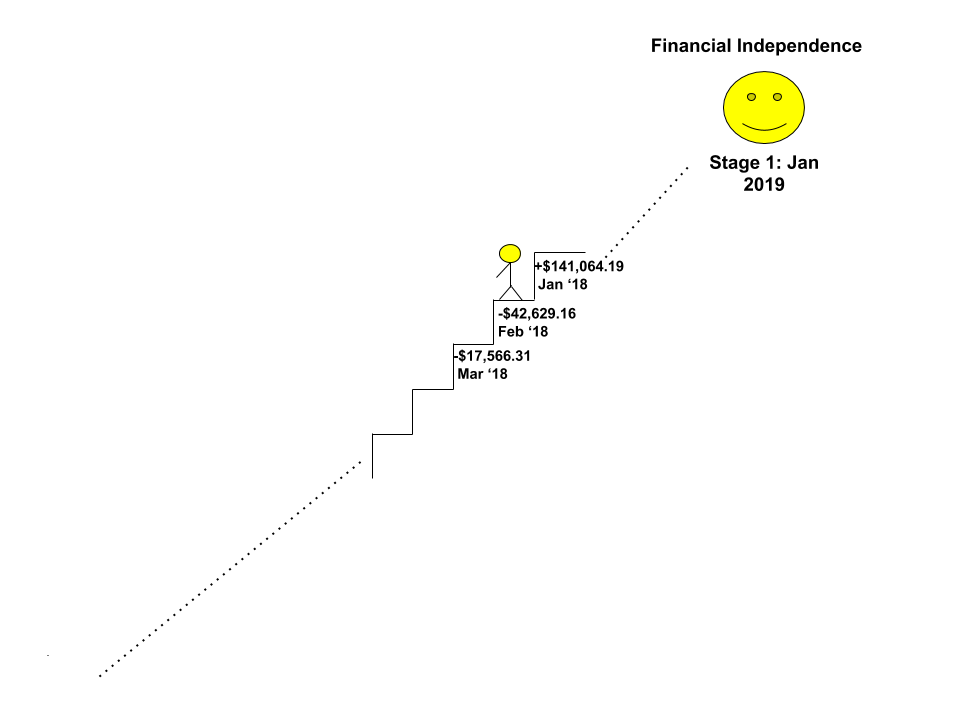

On the Path to Financial Independence: March 2018

I started March off in far off lands. I visited India for my cousin’s wedding. It was my first visit to India in 5 years – the last time I was in India was for my own wedding. It was an awfully short visit. I was in India for three […]

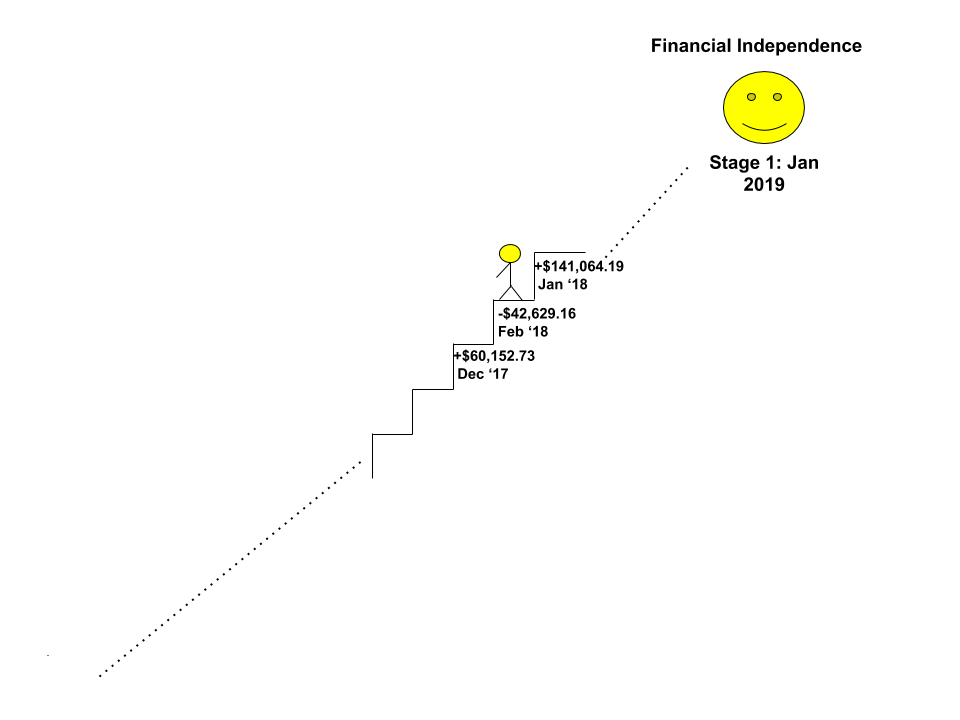

On the Path to Financial Independence: February 2018

In contrast with the tumult in the markets, February was a quiet month at the BITA household. In the aftermath of my newly acquired citizenship I continued my dealings with consulates and other government agencies. In February I Applied for the renunciation of my Indian passport ($232.88) Applied for an […]

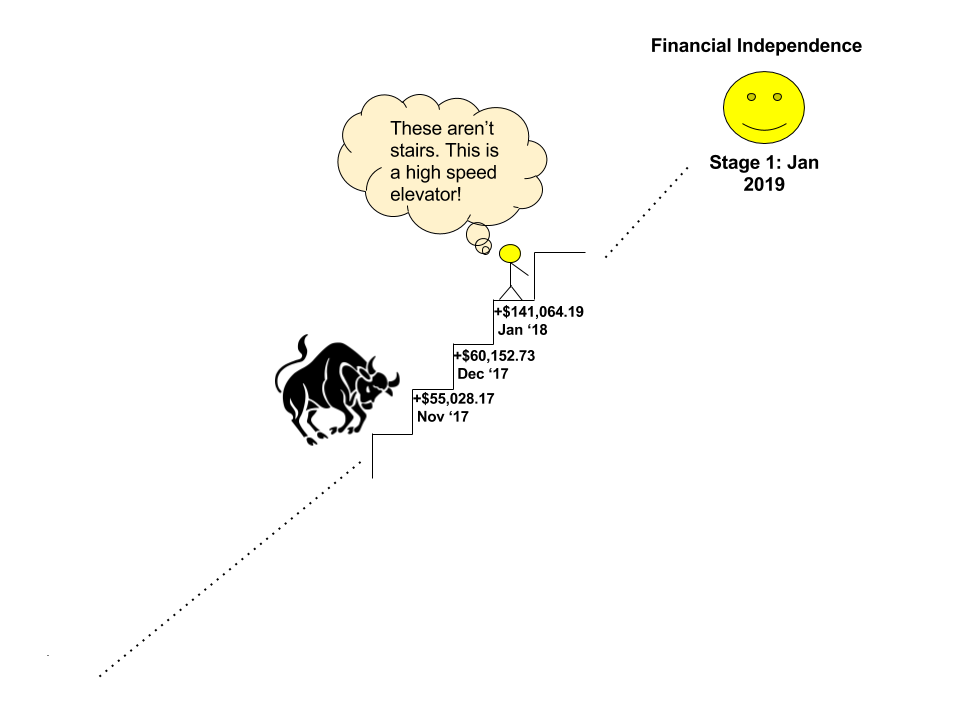

On the Path to Financial Independence: January 2018

We started the new financial year with a bang, thanks to the crazy bull. January was our biggest month ever financially, but before we get to the juicy numbers, let’s talk about life at the BITA household. The big news from January is that my oath ceremony was in […]

Magic Internet Money

Thus far the BITA portfolio has been an unexciting place, more quiet suburb than Disney Land. The vast majority of our holdings are in diversified index funds (like good old VTSAX) with low expense ratios. In December I decided to spice up the place and added a single roller coaster […]

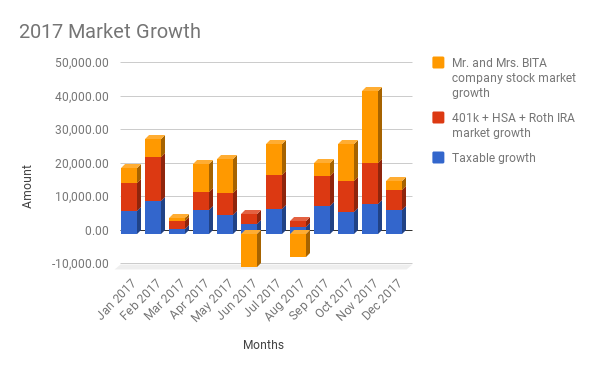

2017: A Year In Review

Before 2017 fades into the past as a distant memory, I thought I might take a moment to review our financials for the year. We started tracking our money in September of 2016 so 2017 was the first full year where we tracked our money. 2017 Savings 2017 was […]

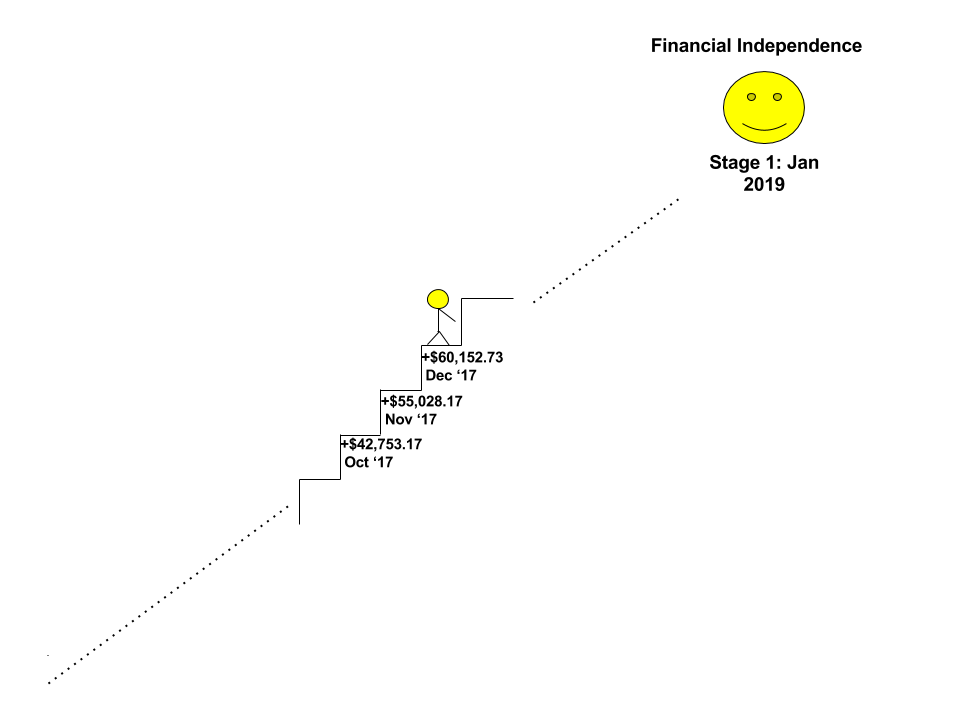

On the Path to Financial Independence: December 2017

And just like that, 2017 is in our rear view. A Happy New Year to all of you! If all goes according to plan, we have now officially begun my last year of working a 9-5 corporate job. So very many wheeeees! There will be time enough in 2018 […]

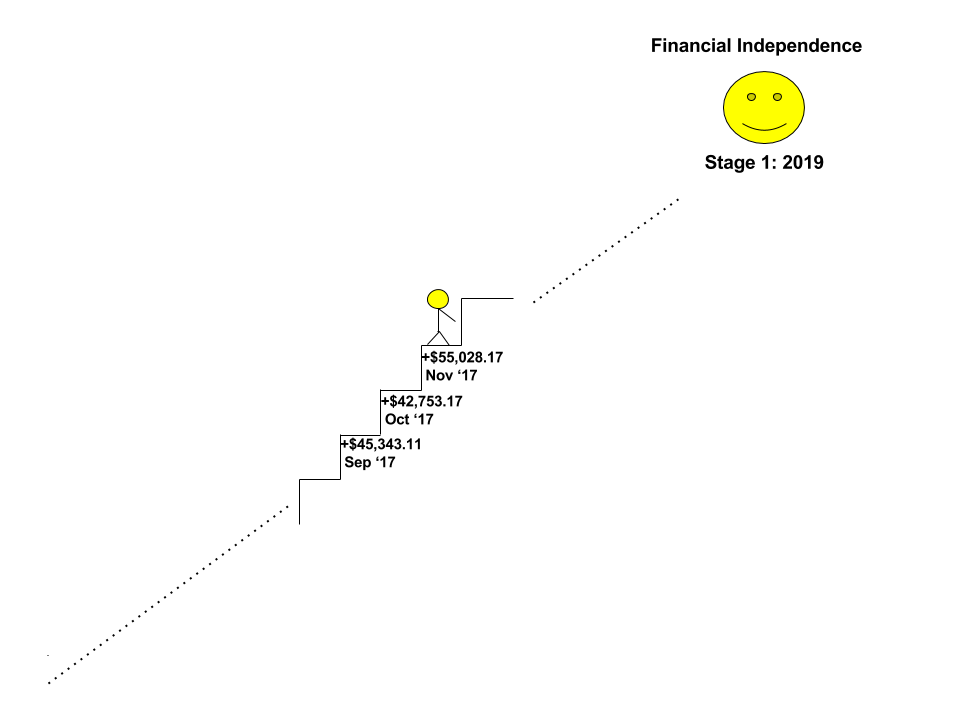

On the Path to Financial Independence: November 2017

Whooosh! Another month whizzed by at breakneck speed. November started off at a sedate enough pace. We spent the early part of the month visiting our local library. Toddler BITA enjoyed exploring the new outdoor play area at the Children’s Discovery Museum (the membership to which was a birthday gift […]

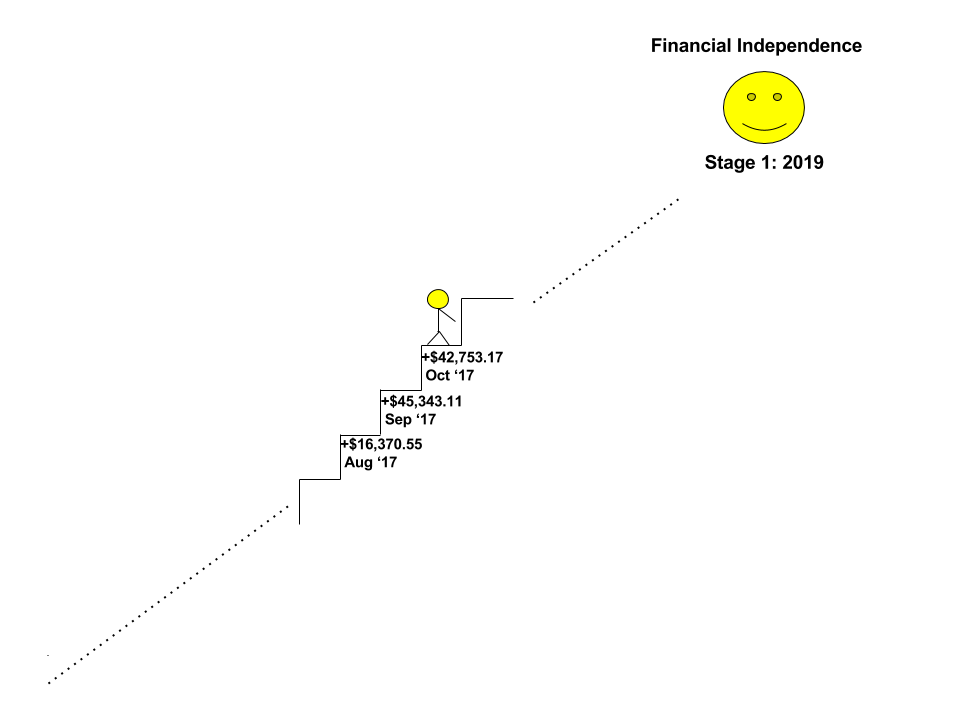

On the path to financial independence: October 2017

What a month! October whizzed past and left me breathless in its wake. I kicked off October with a trip to Orlando for a work-related conference: the Grace Hopper conference for women in technology. This beast of a conference was attended by 18,000 women and had Big Names […]

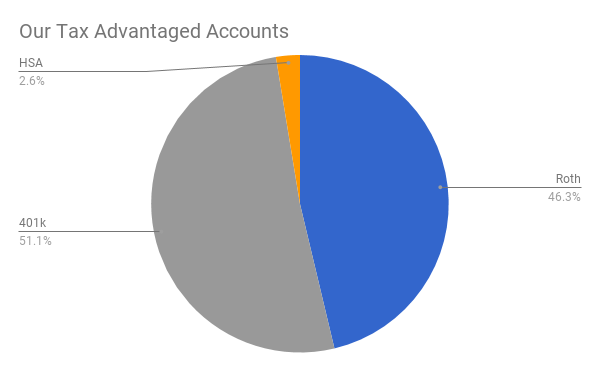

Where Does Our Money Go?

From January to September 2017, we have saved $248,820.66. In today’s post we’re going to look at the kinds of accounts we put that money into and how as high income earners we save as much on taxes as we can by maximizing our tax-advantaged accounts. Tax advantaged accounts typically have […]

On the path to financial independence: September 2017

The BITAs spent most of September gallivanting around Europe. We visited Lisbon, Amsterdam and Split for a glorious nearly 3 week vacation. We were joined by my sister, brother-in-law and my parents, resulting in an ideal Adult:Toddler ratio of 6:1. We kicked off our European sojourn in Lisbon, where […]