Blog Posts

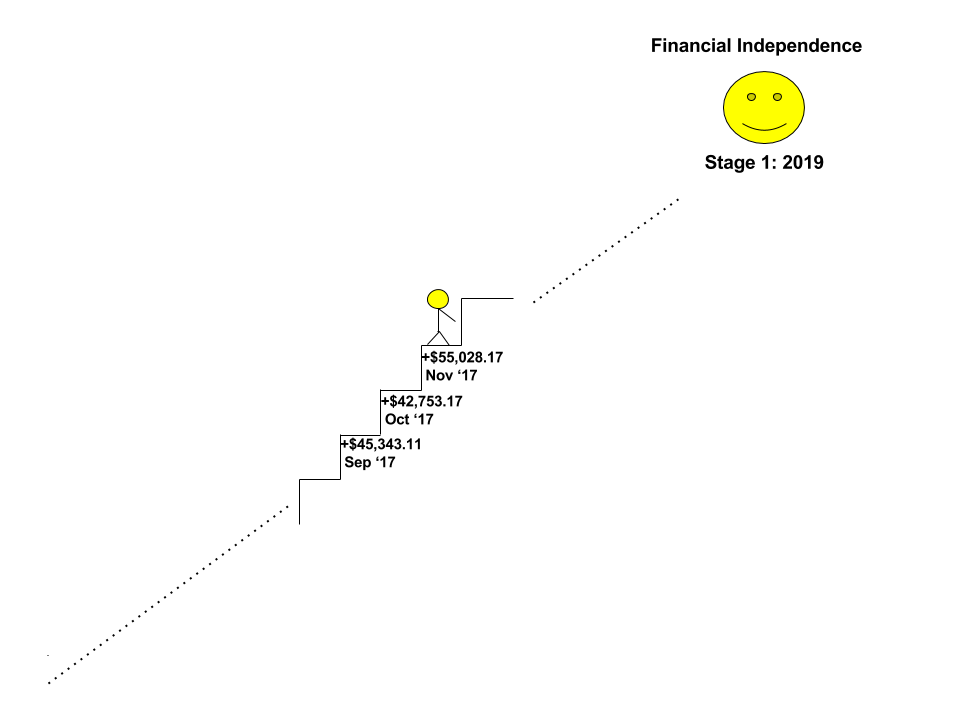

On the Path to Financial Independence: November 2017

Whooosh! Another month whizzed by at breakneck speed. November started off at a sedate enough pace. We spent the early part of the month visiting our local library. Toddler BITA enjoyed exploring the new outdoor play area at the Children’s Discovery Museum (the membership to which was a birthday gift […]

If I Can Do It, So Can You: A Financial Full Monty

Regular readers of this site know that the BITA family is accelerating towards financial independence as fast as we possibly can. In 2017 we have saved and invested north of $260,000 and we don’t intend to slow down until we reach the finish line. What regular readers don’t know are […]

Potential: The Why of Financial Independence

Imagine. Imagine what you would do if you woke one morning and discovered that you were financially independent. After you fainted, and awoke, and whooped, and celebrated and jubiliated and shouted wheeeee! to your heart’s content, what would you do? What would you do if money was no longer a […]

AMT versus the TCJA

Last week the House GOP finally unveiled the draft legislation of their long-awaited tax reform proposal: the “Tax Cuts and Jobs Act” (TCJA). There will be much arguing and many compromises before this draft makes its way into law, but we have some real meat to dig into here after […]

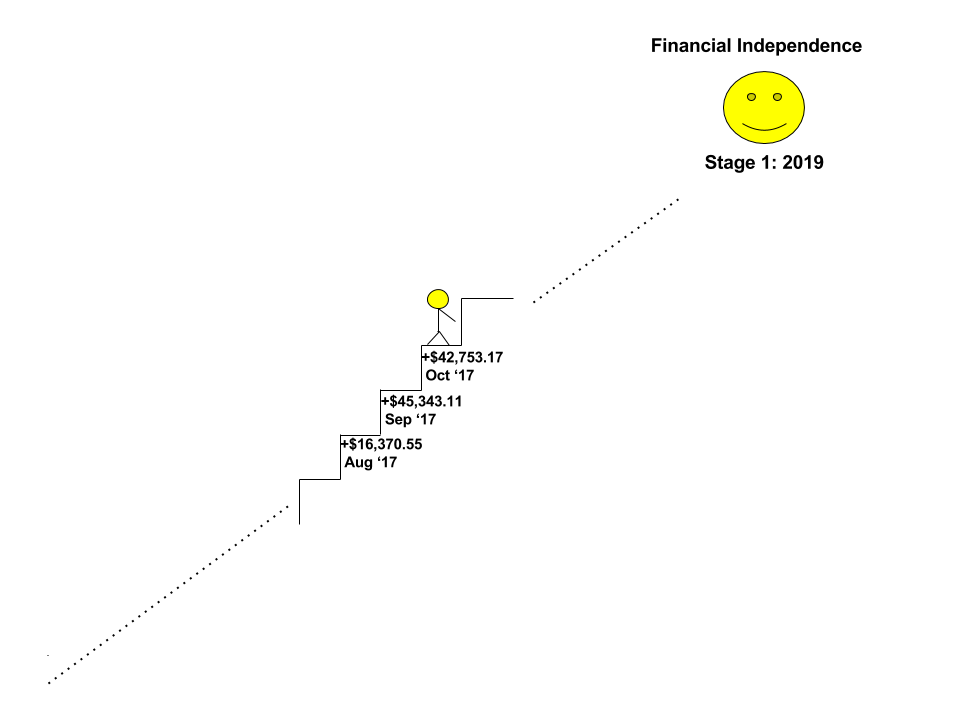

On the path to financial independence: October 2017

What a month! October whizzed past and left me breathless in its wake. I kicked off October with a trip to Orlando for a work-related conference: the Grace Hopper conference for women in technology. This beast of a conference was attended by 18,000 women and had Big Names […]

Don’t Make a Pest of Yourself

Discovering the concepts of financial independence and early retirement can be life changing. You hear the heavenly host, the clouds part and you are bathed in the light. One moment you are an ordinary Jane, doomed to drudgery for decades on end, the next you are a devout FIREee, and […]

Daniel and William Baldwin, and FSAs

In my last post I talked about the various accounts we make use of that allowed us to stash away $95,750 tax advantaged dollars in 2017. We discussed 401ks, Roth IRAs (of the baby backdoor and megabackdoor varieties) and HSAs. There are two more tax advantaged accounts that we make […]

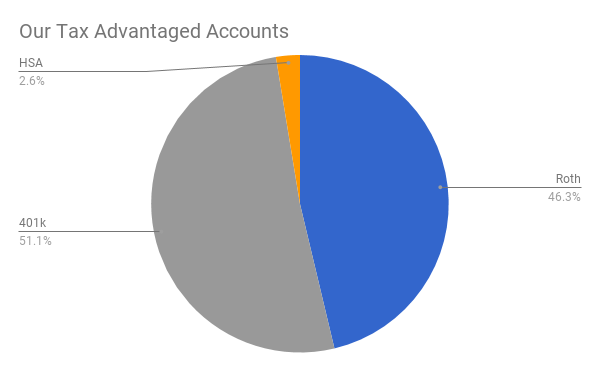

Where Does Our Money Go?

From January to September 2017, we have saved $248,820.66. In today’s post we’re going to look at the kinds of accounts we put that money into and how as high income earners we save as much on taxes as we can by maximizing our tax-advantaged accounts. Tax advantaged accounts typically have […]

The Unexpected Benefits of FIRE

Two days ago I went to the dentist. This is a big fucking deal because the last time I graced a dentist’s office was in 2012. A Horror Story The first clue that there was something off about my dentistry appeared when I was closing in on my 14th […]

I’ve Moved the Finish Line

Big news today! I am super excited to announce that I am pulling in my FIRE date, blog name be damned. I am thrilled and terrified, and so happy that I have you to share this with. A History Lesson A quick recap for those of you that haven’t […]